Publications

Click "summary" links where available for short plain-language summaries of each paper.

Pan, CX, Sokol-Hessner, P (submitted) Trajectories of learning about others: Liking and affiliation follow similar but distinct paths. [preprint] [data & analyses]

Brooks, HR, Sokol-Hessner, P (under review) Cognitive strategy use selectively changes temporal context effects in risky monetary decision-making. [preprint] [data] [poster]

Brooks, HR, Sokol-Hessner, P (2024) Multiple timescales of temporal context in risky choice: Behavioral identification and relationships to physiological arousal, PLOS ONE. [pdf] [link] [data]

Gunderson, C, ten Brinke, L*, Sokol-Hessner, P* (2022) When the Body Knows: Interoceptive Accuracy Enhances Physiological But Not Explicit Differentiation Between Liars and Truth-Tellers, Personality And Individual Differences. [pdf] [link] [preprint] [data & analyses]

Mihalache, D, Sokol-Hessner, P, Feng, H, Askari, F, Reyes, N, Moody, EJ, Mahoor, MH, Sweeny, T (2022) Gaze perception from head and pupil rotations in 2D and 3D: Typical development and the impact of Autism Spectrum Disorder, PLOS ONE. [pdf] [link] [data & analyses]

Fareri, DS, Stasiak, JE, Sokol-Hessner, P (2022) Choosing for another: Social context changes dissociable computational mechanisms of risky decision-making, Scientific Reports. [pdf] [link] [preprint] [data & analyses]

Sokol-Hessner, P, Wing-Davey, M, Illingworth, S, Fleming, SM, Phelps, EA (2022) The Actor’s Insight: Actors have comparable interoception but better metacognition than non-actors, Emotion. [pdf] [link] [data & analyses]

Louie, K, Brooks, HR, Sokol-Hessner, P (2021) Biological constraints on interpretable theories of human decision-making, Science eLetters [pdf] [link]

Brooks, HR, Sokol-Hessner, P (2020) Quantifying the moment-to-moment computational effects of recent outcomes on risky decision-making, Scientific Reports. [pdf] [link] [summary] [data]

Botvinik-Nezer, R, … , Brooks, HR, Erhart, A, Sokol-Hessner, P, … Poldrack, R, Schonberg, T (2020) Variability in the analysis of a single neuroimaging dataset by many groups, Nature. [pdf] [link] [data]

Mihalache, D, Feng, H, Askari, F, Sokol-Hessner, P, Moody, EJ, Mahoor, MH, Sweeny, TD (2019) Perceiving gaze from head and eye rotations: An integrative challenge for children and adults. Developmental Science. [pdf] [link]

Sokol-Hessner, P, Rutledge, R (2019) The psychological and neural basis of loss aversion, Current Directions in Psychological Science. [pdf] [link] [summary]

Hartley, CA, Sokol-Hessner, P (2018) Affect is the foundation of value, in Fox, AS, Lapate, RC, Shackman, AJ, & Davidson, RJ, The Nature of Emotion. [pdf] [summary]

Sokol-Hessner, P, Raio, CM, Gottesman, S, Lackovic, SF, Phelps, EA (2016) Acute stress does not affect risky monetary decision-making, Neurobiology of Stress, 5, p19-25. [pdf] [link] [summary]

Raio, CM, Goldfarb, EV, Lempert, KM, Sokol-Hessner, P (2016) Classifying emotion regulation strategies, Nature Reviews Neuroscience, 17, p532 [pdf] [link] [summary]

Sokol-Hessner, P, Phelps, EA (2016) Affect, decision-making, and value: neural and psychological mechanisms, in Brosch, T., & Sander, D., The Handbook of value: Perspectives from Economics, Neuroscience, Philosophy, Psychology, and Sociology [pdf] [link] [summary]

Boureau, Y-L, Sokol-Hessner, P, Daw, ND (2015) Deciding how to decide: self-control and meta-decision making, Trends in Cognitive Sciences, 19(11), p700-710 [pdf] [link] [summary]

Sokol-Hessner, P, Lackovic, SF, Tobe, RH, Camerer, CF, Leventhal, BL, Phelps, EA (2015) Determinants of propranolol's selective effect on loss aversion, Psychological Science, 26(7), p1123-1130 [pdf] [link] [summary]

Sokol-Hessner, P*, Hartley, CA*, Hamilton, JR, Phelps, EA (2015) Interoceptive ability predicts aversion to losses, Cognition and Emotion, 29(4), p695-701 [pdf] [link] [summary]

FeldmanHall, O, Sokol-Hessner, P, Van Bavel, JJ, Phelps, EA (2014) Fairness violations elicit greater punishment on behalf of another than for oneself, Nature Communications, 5(5306), p1-6 [pdf] [link] [summary]

Phelps, EA, Lempert, KM, Sokol-Hessner, P (2014) Emotion and Decision Making: Multiple Modulatory Neural Circuits, Annual Review of Neuroscience, 37, p263-287 [pdf] [link] [summary]

Sokol-Hessner, P, Camerer, CF, Phelps, EA (2013) Emotion Regulation Reduces Loss Aversion and Decreases Amygdala Responses to Losses, SCAN, 8, p341-350 [pdf] [link] [summary]

Sokol-Hessner, P, Hutcherson, C, Hare, T, Rangel, A (2012) Decision value computation in DLPFC and VMPFC adjusts to the available decision time, European Journal of Neuroscience, 35, p1065-1074 [pdf] [link] [summary]

Stanley, DA, Sokol-Hessner, P, Fareri, DS, Perino, MT, Delgado, MR, Banaji, MR, Phelps, EA (2012) Race and reputation: perceived racial group trustworthiness influences the neural correlates of trust decisions, Philosophical Transactions of the Royal Society B, 367(1589), p744-753 [pdf] [summary]

McRae, K, Gross, J, Robertson, E, Sokol-Hessner, P, Ray, R, Gabrieli, JDE, Ochsner, K (2012) The development of emotion regulation: An fMRI study of cognitive reappraisal in children, adolescents, and young adults, SCAN, 7(1), p11-22 [pdf] [summary]

Phelps, EA, Sokol-Hessner, P (2012) Social and Emotional Factors in Decision-Making: Appraisal and Value, in Dolan, R, Sharot, T, Neuroscience of Preference and Choice: Cognitive and Neural Mechanisms, Academic Press (London), p207-222 [pdf] [summary]

Stanley, DA, Sokol-Hessner, P, Banaji, MR, Phelps, EA (2011) Implicit race attitudes predict trustworthiness judgments and economic trust decisions, PNAS, 108(19), p7710-7715 [pdf] [summary]

Miller, MB, Donovan, C-L, van Horn, JD, German, E, Sokol-Hessner, P, Wolford, GL (2009) Unique and persistent individual patterns of brain activity across different memory retrieval tasks, NeuroImage, 48(3), p625-635 [pdf] [summary]

Sokol-Hessner, P, Hsu, M, Curley, NG, Delgado, MR, Camerer, CF, Phelps, EA (2009) Thinking Like A Trader Reduces Individuals' Loss Aversion, PNAS, 106(13), p5035-5040 [pdf] [summary]

Ofen, N, Kao, Y-C, Sokol-Hessner, P, Kim, H, Whitfield-Gabrieli, S, Gabrieli, JDE (2007) Development of the declarative memory system in the human brain, Nature Neuroscience, 10, p1198-1205 [pdf] [summary]

Quantifying the immediate computational effects of preceding outcomes on subsequent risky choices

Brooks, HR, Sokol-Hessner, P (2020)

We asked how risky decision-making changes, choice-by-choice, in response to recent events. While major decision-making theories like Prospect Theory often state that decision-making is dynamic, they are vague about precisely how and how much - and most studies of risk don’t even look at this, implying that risky decision-making is static. We reanalyzed decision-making data from 4 previous studies. The choice tasks in these studies had no temporal structure or design, and no unknown elements (like probabilities) that could change choices over time. So we were surprised to find that each risky outcome shapes the next risky choice - people take more risks after losses, and fewer after gains. The effect is short-lasting, does not differ between loss and gain or risky and safe outcomes, and is related to outcome amount, not just outcome type. Non-linear hierarchical Bayesian models find both value-dependent and -independent effects of previous outcomes on subsequent choices. For a variety of reasons we believe that learning is not a compelling explanation. Instead, we think the evaluation of risky options is fundamentally more dynamic and contextually sensitive than has previously been appreciated.

The psychological and neural basis of loss aversion

Sokol-Hessner, P, Rutledge, R (2018)

In this brief review, we aim to understand who is loss averse, how it interacts with affect, and the ways in which loss and reward processing in the brain affects choices. Loss aversion refers to the extent to which individuals overweight losses relative to equivalent gains and is a key component of prospect theory, the dominant theory for studying decision-making under uncertainty over the past forty years. Here we integrate recent affective and neurobiological findings to propose a new neural and computational framework for understanding why and how loss aversion occurs. We propose that loss aversion and risk taking have separate neural mechanisms. Specifically, changes in the neurotransmitter norepinephrine will influence loss aversion, while changes in dopamine will have a specific effect on risk taking, but not loss aversion. We also propose that loss aversion has an underappreciated temporal structure such that affective responses to gains and losses represent the anticipated and immediate experience of gains and losses, but such responses quickly equilibrate. Finally, we consider challenges to loss aversion, one of which is the recent evidence of context dependence. While loss aversion varies across individuals and settings, we propose that it remains a stable individual difference measure and is useful for predicting choices in healthy and psychiatric populations.

Acute stress does not affect risky monetary decision-making

Sokol-Hessner, P, Raio, CM, Gottesman, S, Lackovic, SF, Phelps, EA (2016)

In this study, we examined how acute stress influences the risks people take. A number of studies examining the interaction between stress and risky decision-making have led to different conclusions, so it is unclear whether and how stress and risk-taking interact. These inconsistencies may be because decisions under risk reflect many things, including attitudes about risk, aversion to losses, and the extent to which a chooser is consistent across choices. Here, in a large, fully-crossed two-day within-subjects design, on each day, participants placed one arm in a water bath (which was sometimes filled with ice water, and sometimes with lukewarm water). When the water is cold (called the cold pressor task), that creates acute stress responses. We then measured whether acute stress led to changes in three separable decision-making processes: risk attitudes, loss aversion, and choice consistency. While the ice water bath did lead to acute stress responses, there were no changes in the 3 decision-making processes. This is strong and specific evidence that acute stress does not influence risk attitudes, loss aversion, or choice consistency in risky monetary decision-making.

Classifying emotion regulation strategies

Raio, CM, Goldfarb, EV, Lempert, KM, Sokol-Hessner, P (2016)

In this brief correspondence, we responded to a previously proposed framework for classifying emotion regulation strategies into one of two separate categories. The first category, “model-based”, is defined by when actions are selected based on prospective planning that considers situational information, the consequences of a given action, and the desirability of possible outcomes. The second, “model-free”, is defined by when actions are selected simply based on what was successful before, without consideration of situational information, action consequences, or outcomes. Using insights from research on decision-making and classical conditioning, we argue that emotion regulation strategies are likely not purely one or the other. Instead, we propose a more nuanced system that classifies emotion regulation strategies based on the degree to which they involve model-based and model-free elements. Links to the original opinion piece and the original author’s response are also included on the PDF.

Deciding how to decide: self-control and meta-decision making

Boureau, Y-L, Sokol-Hessner, P, Daw, ND (2015)

In this brief review/opinion, we discussed meta-decision making, that is, deciding how to decide. The basic idea is that you have many ways to make a decision in any given scenario. Each way differs in how much it asks of you (e.g. pick the action that worked the best last time vs. think through consequences of all your possible actions and the ultimate items you may receive and the corresponding experience of reward or punishment they entail). It's not always best to decide in the most intense way because doing so requires a lot of you, that is, it uses up your resources (like your attention, working memory, or time) - it has a cost. How much cost? That depends on what else you can use the resources for at the same time, and how much better of a decision you may make if you do use those additional resources. This "rational" approach to meta-decisions might explain some of what we see in habits, emotion regulation, and self-control, and may prove to be an underlying, fundamental principle of decision making.

Affect is the foundation of value

Hartley, CA, Sokol-Hessner, P (2018)

In this short chapter/opinion piece, we reviewed some of the evidence showing how particular components of affect can modulate or shift specific processes in decision-making, and argued that the very concept of value is fundamentally rooted in affect. It’s increasingly clear that assessing the value of something takes time, that an estimate of value has to be constructed. We contend that an object’s value is constructed from “samples” of affective associations with its attributes (which can be from direct experience or simulation). In a sense, this means that no decision is ever free from affective influence – there would be no value without affect, and without value, there is no meaningful choice to be made.

Affect, decision-making, and value: neural and psychological mechanisms

Sokol-Hessner, P, Phelps, EA (2016)

In this chapter, we looked at how affect (a broad term covering discrete emotions like fear or happiness as well as things like stress or moods) interacts with decision-making and specifically, with assessments of value, using evidence from both psychology and neuroscience. We looked at a number of ways that components of affect (like physiological arousal responses, facial expressions, or acute stress responses) interact with components of decision-making (like trust decisions, loss aversion, and learning), using evidence from studies that either measured affect during otherwise normal decision-making or manipulated affect, and looked for changes in choices. We argued that understanding the relationships between affect and decision-making requires being very specific about both so that we can understand the ways in which they do, and do not, interact.

Determinants of propranolol's selective effect on loss aversion

Sokol-Hessner, P, Lackovic, SF, Tobe, RH, Camerer, CF, Leventhal, BL, Phelps, EA (2015)

Our previous studies had suggested a specific, causal hypothesis: signals from the amygdala produced arousal responses and drove loss aversion. Studies of memory and fear learning have also identified amygdala-based, arousal-related systems, but those studies additionally found a particular neurotransmitter, noradrenalin, was critical – if noradrenalin was blocked with drugs, the amygdala-based system no longer altered behavior. Here we asked whether this same amygdala-based modulatory system was involved with loss aversion, using the beta-blocker propranolol to block noradrenalin during risky monetary decision-making. Propranolol only affected loss aversion (and not risk aversion or choice consistency), reducing it subject to how loss averse someone was to begin with (greater reductions for very loss averse people) and body mass index (greater reductions for smaller people, which we interpreted as “dose dependence” since everyone got the same dose of propranolol, but everyone was not the same size). This is strong, causal evidence that specific emotion-related circuits drive specific parts of decision-making.

Interoceptive awareness predicts aversion to losses

Sokol-Hessner, P*, Hartley, CA*, Hamilton, JR, Phelps, EA (2014)

The idea that our emotions are related to our decisions suggests that the degree to which we can perceive our emotions may be important. In this study, we measured participants’ ability to perceive their internal bodily states (called “interoception”) with a heartbeat detection task, and asked whether this correlated with their decision-making. We found that interoception correlated with loss aversion only (and not risk aversion or consistency in decision-making), aligning with our previous studies in arguing for a very specific relationship between bodily signals and decision-making.

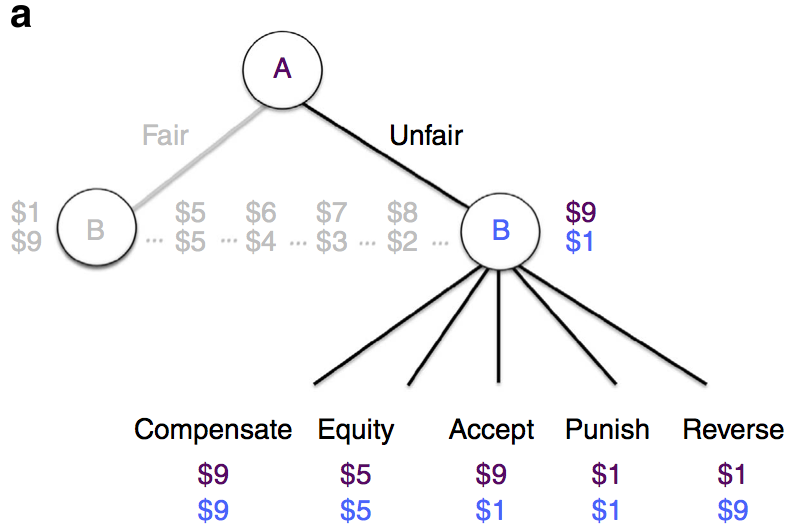

Fairness violations elicit greater punishment on behalf of another than for oneself

FeldmanHall, O, Sokol-Hessner, P, Van Bavel, JJ, Phelps, EA (2014)

How do people respond to being treated unfairly? While most studies on this question have focused on whether and how much people use punishment to right a wrong, here we offered participants more options for responding to someone acting unfairly, including options that focused on the victim (and restoring their situation). In a number of studies with a total of several hundred participants, we found that people preferred compensating victims to punishing offenders, even when they could freely choose between either option. However, when someone else was being treated unfairly and our participants had a chance to intervene, they chose punishment more often – an intriguing mismatch between what we choose for ourselves and for others.

Emotion and Decision Making: Multiple Modulatory Neural Circuits

Phelps, EA, Lempert, KM, Sokol-Hessner, P (2014)

This comprehensive review discussed the neuroscience behind the complex interactions of emotion and decision-making. We discussed how affect (a broader term covering discrete emotions like fear or happiness as well as things like stress or moods) could interact with decisions in two ways – either incidentally, when they are irrelevant to the choice at hand but still exert influence, or when they are part and parcel of the value assessment we use to decide. We also covered how changing emotions can change choices, like in Sokol-Hessner et al, 2009 and 2013. Broadly speaking, we argued that the neuroscience showed that the interactions between affect and decision-making were best described as “modulatory” – affect didn’t introduce anything that wasn’t there, but specific components of affect shifted how specific ongoing decision processes worked.

Emotion Regulation Reduces Loss Aversion and Decreases Amygdala Responses to Losses

Sokol-Hessner, P, Camerer, CF, Phelps, EA (2013)

In a study following up on Sokol-Hessner et al, 2009, we examined the neural correlates underlying loss aversion and its reduction when people took a different perspective (a strategic approach similar to some kinds of emotion regulation). We found that a region of the brain called the amygdala had a greater response to losses than to wins, and that this correlated with individual participants’ level of loss aversion – something that makes sense because we know physiological arousal (as shown in Sokol-Hessner et al, 2009) is often closely related to amygdala activity. We also found that success in reducing behavioral loss aversion correlated only with the reduction in amygdala responses to losses and was unrelated to any changes in responses to wins. Finally, we found that areas of the brain related to the perspective-taking itself were similar to those from more classic emotion regulation studies, suggesting that thinking differently about your choices relies on similar brain mechanisms as emotion regulation.

Decision value computation in DLPFC and VMPFC adjusts to the available decision time

Sokol-Hessner, P, Hutcherson, C, Hare, T, Rangel, A (2012)

Figuring out the value of something takes time, so in this study we manipulated the length of time people had to decide whether to eat food objects while we scanned them with fMRI to see how that might change choices and their underlying neural basis. We found that value computations were very flexible, beginning immediately and expanding to fill the available time (with no obvious change in decision quality or pattern), but also that one region, the dorsolateral prefrontal cortex, seemed to lag behind another, the ventromedial prefrontal cortex, suggesting that value information might be shared across these regions.

Race and reputation: perceived racial group trustworthiness influences the neural correlates of trust decisions

Stanley, DA, Sokol-Hessner, P, Fareri, DS, Perino, MT, Delgado, MR, Banaji, MR, Phelps, EA (2012)

In a follow-up study to Stanley et al (2011) (see below), participants made similar “trust decisions” with real monetary consequences during fMRI scanning to assess how decisions to trust a stranger (and the influence of race) were represented in the brain. We found a complex pattern of results: a region called the striatum represented how much the participant trusted blacks vs. whites in the game, while activity in another region, the amygdala, scaled more intensely with the amount invested for black partners than white partners. These findings highlighted the complexity of the circuitry underlying how we evaluate other people, and our interactions with them.

The development of emotion regulation: An fMRI study of cognitive reappraisal in children, adolescents, and young adults

McRae, K, Gross, J, Robertson, E, Sokol-Hessner, P, Ray, R, Gabrieli, JDE, Ochsner, K (2012)

Participants ranging from 10-24 years old completed an emotion regulation task that separately identified how intensely they reacted to emotional stimuli, and how well they regulated those responses using reinterpretation or perspective taking (called “reappraisal”). Everyone had similar reactivity to emotional stimuli, we found reappraisal ability (and the neural regions thought to support it) changed in complex ways with age: while some regions (associated with “cognitive control”) linearly increased with age, portions of the brain associated with thinking about other people were engaged less by adolescents compared to adults or children (though instructions could reduce this effect).

Social and Emotional Factors in Decision-Making: Appraisal and Value

Phelps, EA, Sokol-Hessner, P (2012)

In this book chapter, we discussed how social and emotional factors can powerfully influence decision-making. The chapter argued for the centrality of appraisal in that much of the influence of these factors can be traced back to changes in how decision options are evaluated, and reviewed how the categories of emotional and social factors are often overlapping (e.g. faces are used to induce emotions, or the influence of social group may in fact be via emotional mechanisms).

Implicit race attitudes predict trustworthiness judgments and economic trust decisions

Stanley, DA, Sokol-Hessner, P, Banaji, MR, Phelps, EA (2011)

Participants played an “economic game” designed to measure how much they trusted strangers identified with facial photos, and then later we measured participants’ implicit racial attitudes (quantifying the strength of our participants’ automatic negative associations with black versus white people), as well as their explicit (e.g. self-reported) racial attitudes. We found that, above and beyond explicit attitudes, implicit attitudes robustly predicted how much participants trusted black versus white strangers, suggesting that these implicit, automatic associations may have very real effects on our interactions with others.

Unique and persistent individual patterns of brain activity across different memory retrieval tasks

Miller, MB, Donovan, C-L, van Horn, JD, German, E, Sokol-Hessner, P, Wolford, GL (2009)

A single set of participants was scanned using fMRI on two separate occasions, months apart, performing several kinds of memory tasks each time, and we examined the patterns of activity to see how similar they were across tasks, time, and people. We found that brain activity was very similar within person across both time and tasks, but people could look very different from each other (even when doing the same task!) arguing that individual variability, especially in strategic memory tasks, may be an important and underappreciated issue when analyzing the brain activity of groups of people.

Thinking Like A Trader Reduces Individuals' Loss Aversion

Sokol-Hessner, P, Hsu, M, Curley, NG, Delgado, MR, Camerer, CF, Phelps, EA (2009)

We examined risky monetary decision-making using econometric methods to separate and quantify participants’ loss aversion (how much they weighed losses relative to gains), attitudes about risk or chance, and consistency in decision-making, and found that loss aversion alone correlated with how much participants sweat, per dollar, when they lost compared to when they won. When our participants thought differently about their choices, put them in context as one of many decisions, it had the dual effects of reducing loss aversion (without affecting risk attitudes or consistency), and reducing the relative “over-arousal” to losses, showing that we have the power to change not only how we choose, but our emotional responses to those choices and their outcomes.

Development of the declarative memory system in the human brain

Ofen, N, Kao, Y-C, Sokol-Hessner, P, Kim, H, Whitfield-Gabrieli, S, Gabrieli, JDE (2007)

In a study of how memories are formed or encoded in people from ages 8 to 24, we found that recognition for vividly recollected scenes improved, and while both prefrontal cortex (PFC) and medial temporal lobe regions were related to successful encoding, only PFC activity increased with age. This increase in activity correlated with the increase in memory performance, suggesting that changes in memory from childhood to adulthood are most closely related to changes in prefrontal cortex, not the medial temporal lobe.